Form 1099-MISC Limit

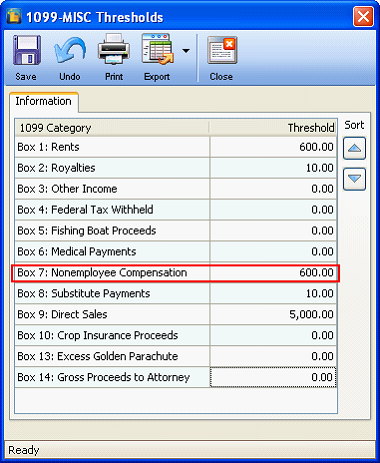

The 1009-MISC Thresholds form – Box 7: Nonemployment Compensation ($600) works hand in hand with Form 1099-MISC and Form 1099-MISC (2 Part) reports.

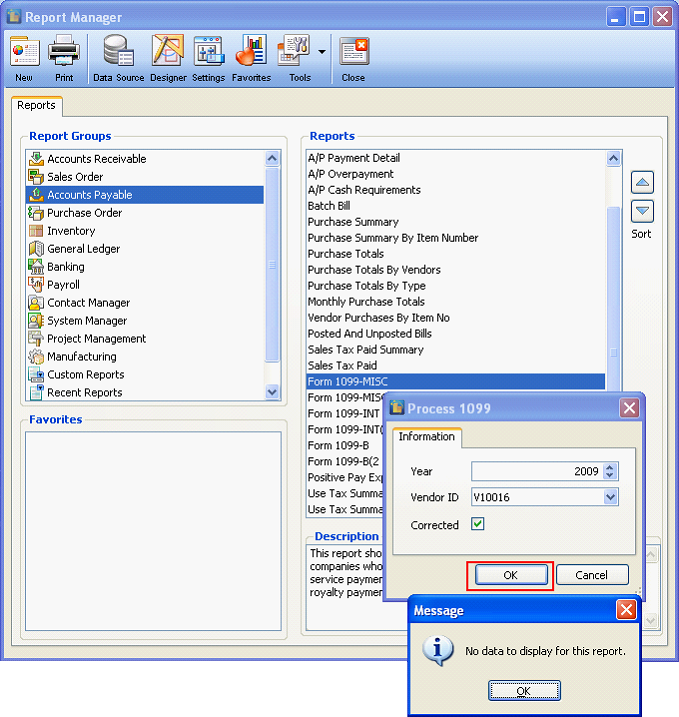

The following will show you how it works.

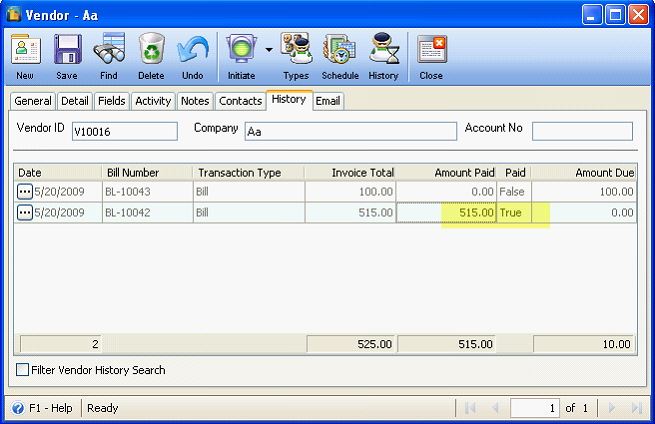

If the Total Paid Bills of a vendor is below $600 (Box 7: Nonemployment Compensation ($600),

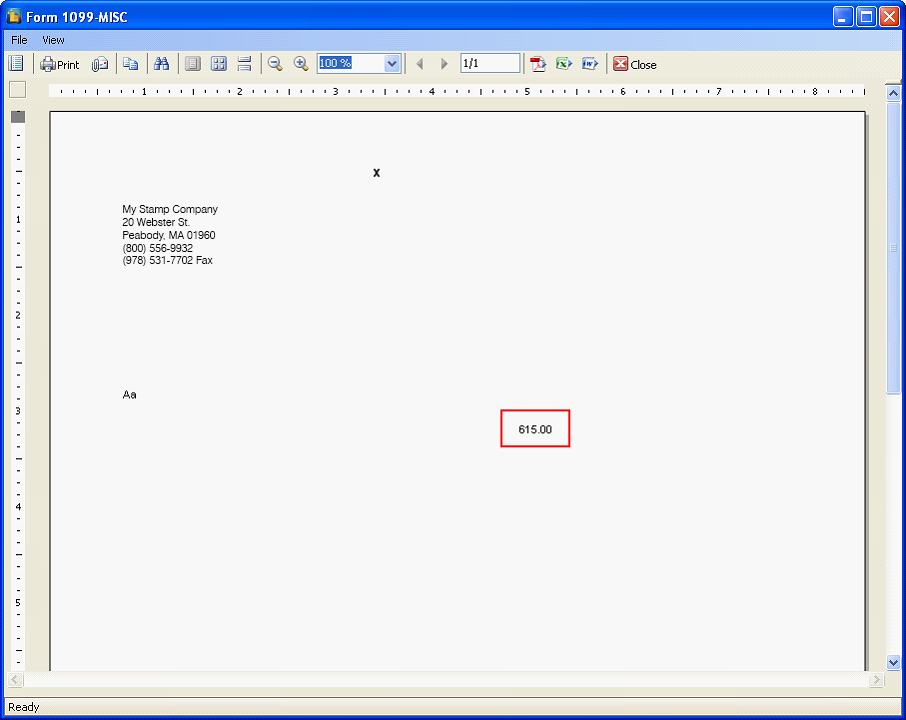

Then the said amount will not be displayed when printing Form 1099-MISC reports.

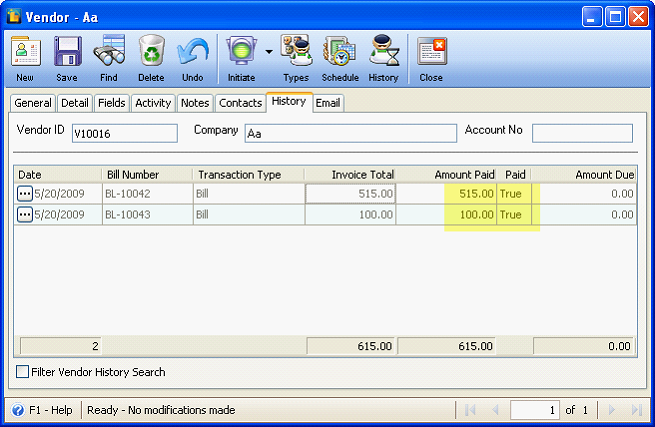

But if the Total Paid Bills has exceeded the limit that is $600 then that amount should be displayed in the Form 1099-MISC reports.