Voiding Checks

VOIDING PAY BILLS

I. Voiding Pay Bills written in a period that is OPEN. ‘Enable check reversal for voiding options’ is DISABLED.

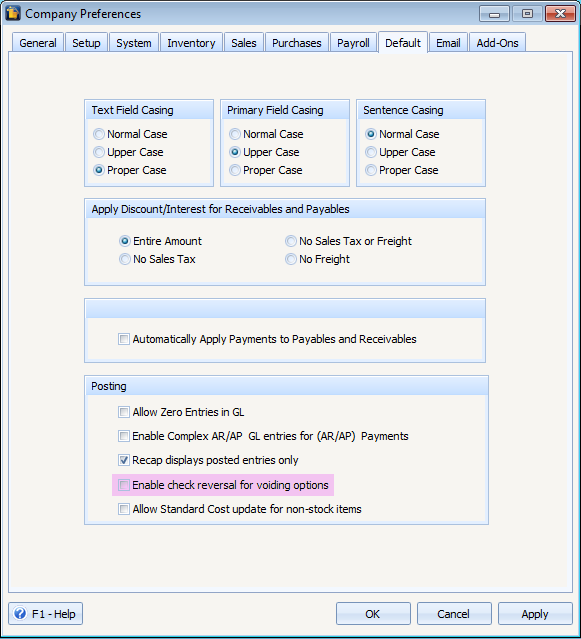

The Enable check reversal for voiding options check box can be accessed from the System menu > Company Preferences > Default tab.

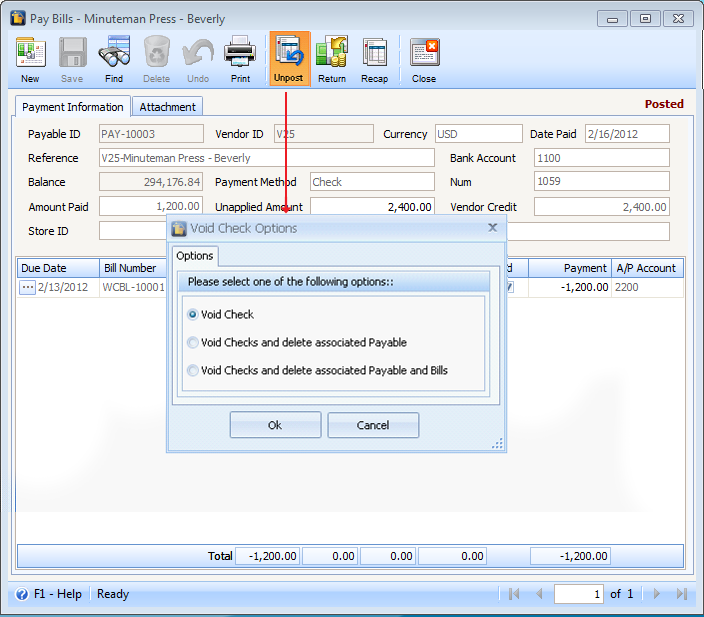

When you click the Unpost button, the Void Check Options form appears which gives you three options.

| • | Void Checks – this option will mark the corresponding Check Number as void |

| • | Void Checks and delete associated payable – this option will mark the corresponding Check Number as void and automatically deletes the associated Pay Bills transaction. |

| • | Void Checks and Delete Associated Payables and Bills – this option will mark the corresponding Check Number as void and automatically deletes the associated Bills and Pay Bills transaction. |

II. Voiding Pay Bills written in a period that is CLOSED. ‘Enable check reversal for voiding options’ is DISABLED.

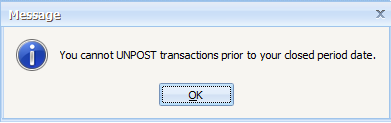

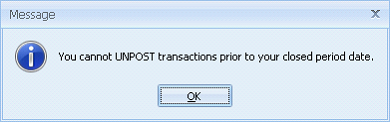

When you click the Unpost button, the system will give a message that the transaction cannot be unposted.

III. Voiding Pay Bills written in a period that is either OPEN or CLOSED. ‘Enable check reversal for voiding options’ is ENABLED.

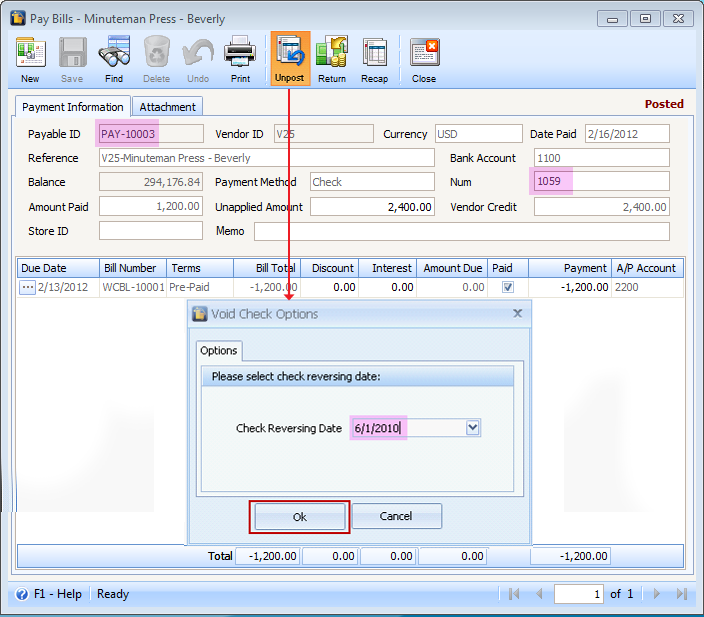

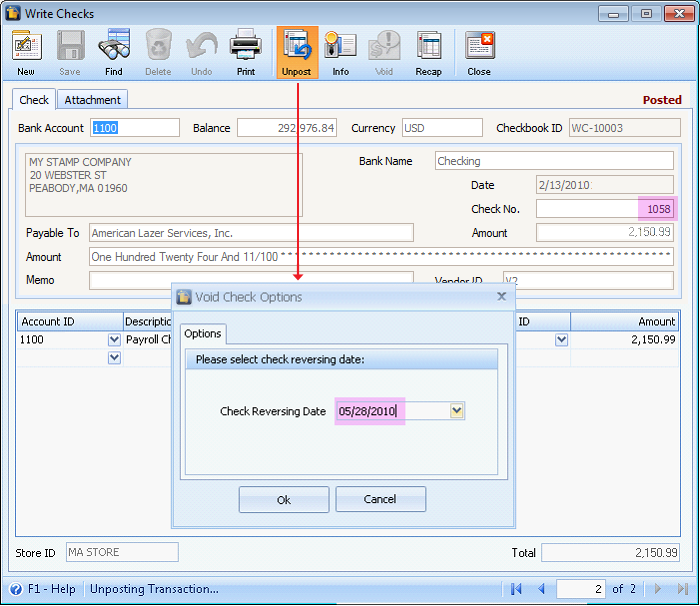

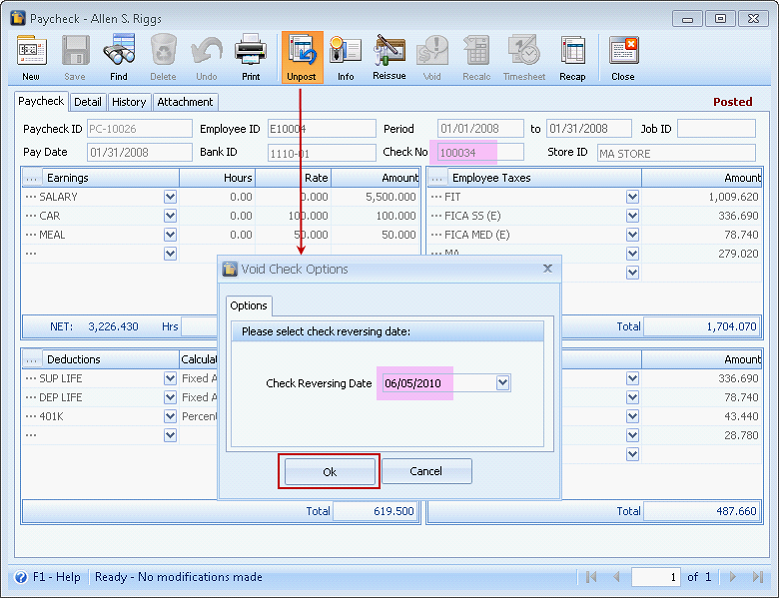

When you click the Unpost button, the Void Check Options form appears. This form enables you to set the Check Reversing Date which is the date the new Pay Bill creates and posts the General Ledger reverse entry.

| • | Clicking the Ok button will proceed to the voiding of Pay Bill. |

| • | Clicking the Cancel or X button will simply close the form. |

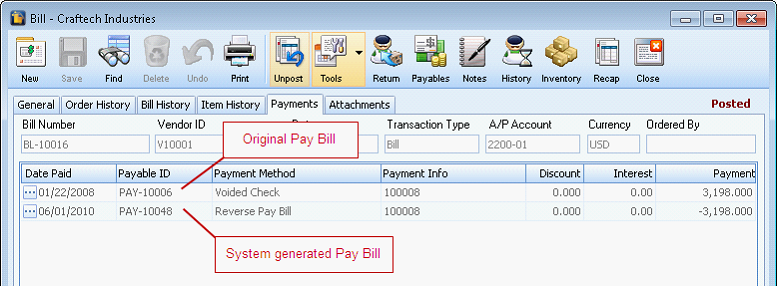

If you proceed with voiding the Pay Bill, the system will create a Reverse Pay Bill. This is a duplicate pay bill record of the voided pay bill dated on the selected Check Reversing Date. The reason for creating this record is to have a negative payment amount report appearing in the aging report. It will represent the reverse GL entries posted by the voiding process. This will help match the total payable in the Balance Sheet report and the AP Aging report.

The Reverse Pay Bill transaction can be viewed in the Purchases menu > Bill > Payments tab.

![]() Note: The new payment will also appear here once payments were made.

Note: The new payment will also appear here once payments were made.

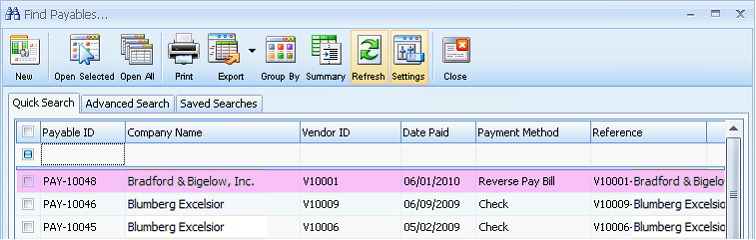

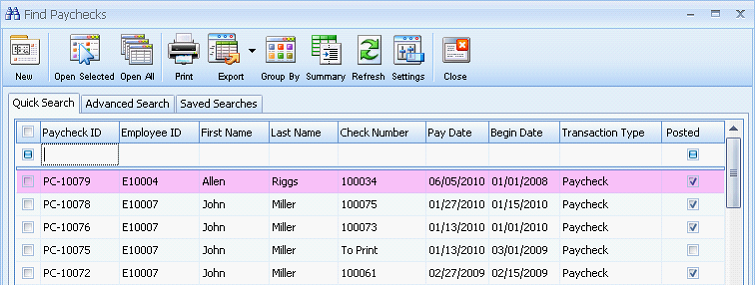

The Reverse Pay Bill form can be viewed in the Payables find form.

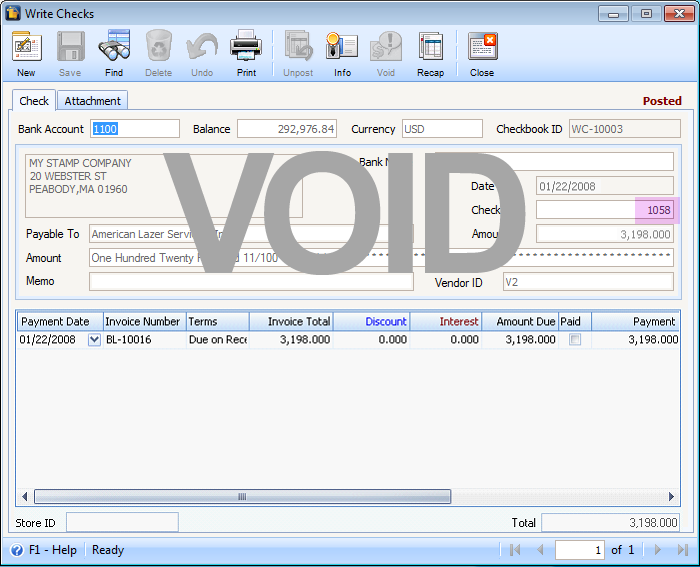

The corresponding check of the voided Pay Bill will also be marked as void.

VOIDING WRITE CHECKS

I. Voiding Write Check written in a period that is OPEN. ‘Enable check reversal for voiding options’ is DISABLED.

With above conditions, when you click the Unpost button the system will simply unpost the paycheck.

II. Voiding Paychecks written in a period that is CLOSED. ‘Enable check reversal for voiding options’ is DISABLED.

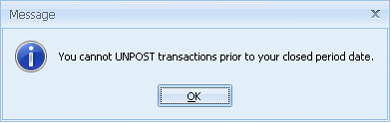

When you click the Unpost button, the system will give a message that the transaction cannot be unposted.

III. Voiding Write Checks written in a period that is either OPEN or CLOSED. ‘Enable check reversal for voiding options’ is ENABLED.

If you choose to void the check, the system will perform the following steps:

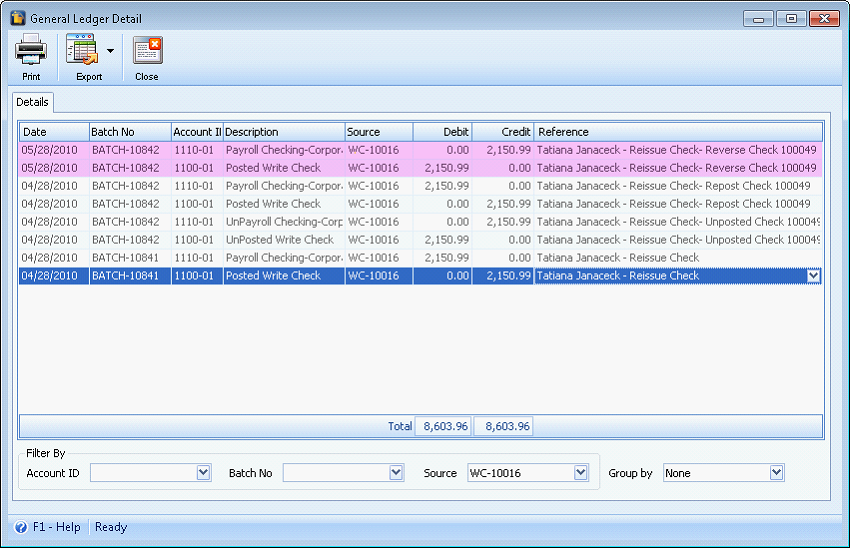

| • | The write check will create the GL reverse entries and will be posted in the selected ‘Check Reversing Date’. |

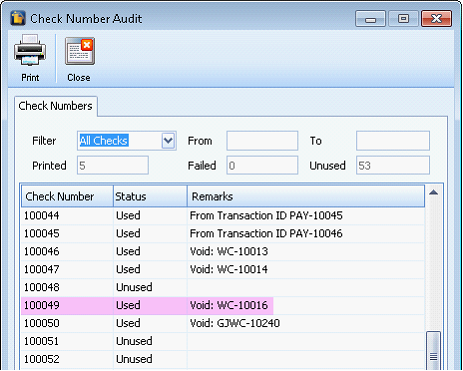

| • | The check number is voided in the Check Number Audit log. |

| • | The Write Check will be marked as void. |

VOIDING PAYCHECK

I. Voiding Paychecks written in a period that is OPEN. ‘Enable check reversal for voiding options’ is DISABLED.

With the above conditions, when you click the Unpost button the system will simply unpost the paycheck.

II. Voiding Paychecks written in a period that is CLOSED. ‘Enable check reversal for voiding options’ is DISABLED.

When you click the Unpost button, the system will give a message that the transaction cannot be unposted.

III. Voiding Paychecks written in a period that is CLOSED. ‘Enable check reversal for voiding options’ is ENABLED.

This situation applies to those rare instances where a payroll check from a previous period’s accruals should not be touched. In these cases, the IRS and other tax agencies expect the employers to adjust the amount sent in the next period. The key here is that it needs to be counted on the employee’s W2 for the current period – not the previous one. In this essence, a void here of a paycheck is not a void at all – simply a reversal of the previous paycheck in the current period.

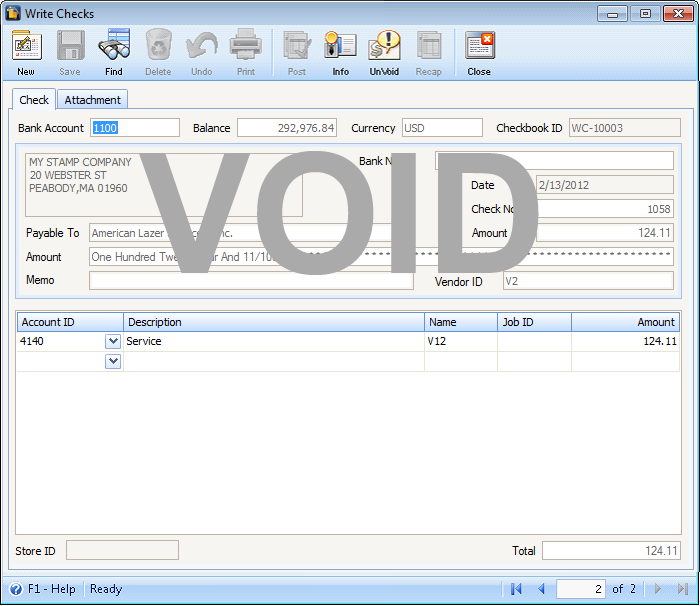

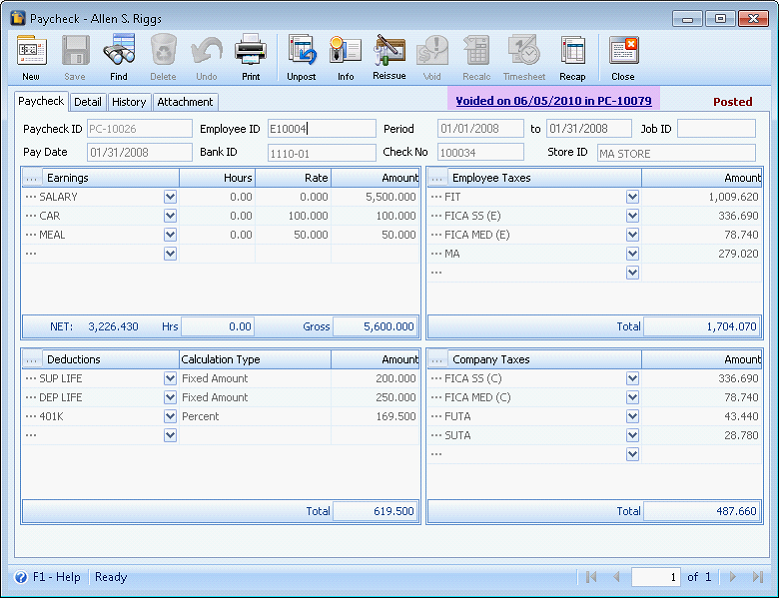

If you proceed with voiding the Paycheck, the system will create an inverse copy of the original paycheck using the date specified in the Void Check Options form. This is like a negative paycheck transaction which can be loaded from the hyperlink on the original paycheck form and can be viewed in Find Paycheck form.

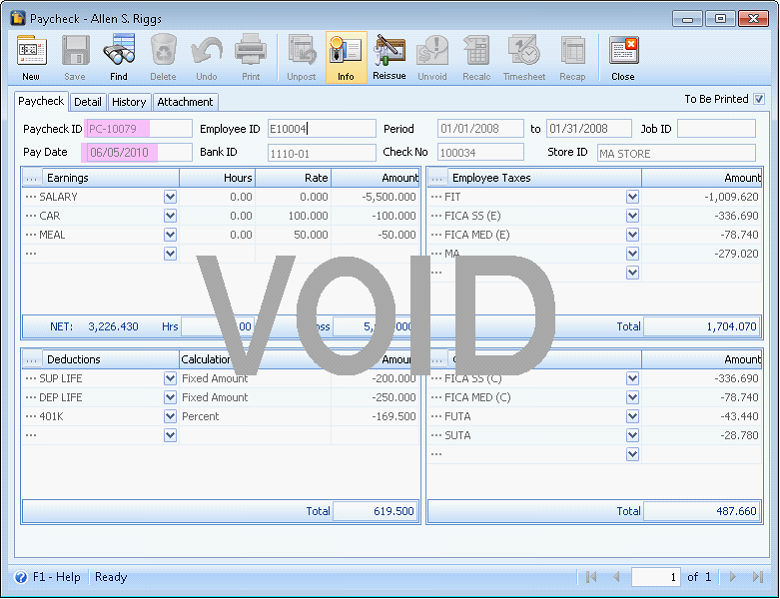

This is how the negative paycheck looks like. Notice that the copy is automatically marked as void.

![]() Note that the date on the negative paycheck transaction (see above sample) is similar to the date entered on the Void Check Options form. This transaction is also automatically posted on the same date which means that the General Ledger entries of the reverse paycheck are exactly the same General Ledger entries when the system unposts a paycheck.

Note that the date on the negative paycheck transaction (see above sample) is similar to the date entered on the Void Check Options form. This transaction is also automatically posted on the same date which means that the General Ledger entries of the reverse paycheck are exactly the same General Ledger entries when the system unposts a paycheck.

IV. Voiding Paychecks written in a period that is OPEN. ‘Enable check reversal for voiding options’ is ENABLED.

If the system found the paycheck date is within the current month and open period, the system will simply void the paycheck and create the GL reversal entries and post it on the date specified in the Void Check Options form.