Bank Reconciliation Enhancement

This documentation will discuss the enhancements made on the Bank Reconciliation form.

The Range button will allow you to clear bank or check transactions by Reference Number or Date Range.

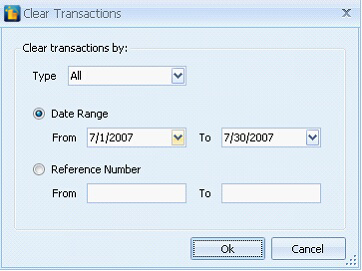

Clicking the Range button will bring out the Clear Transaction form.

| • | The Type field is a combo box field where you can choose the account type transactions you wanted to mark as checked. For Bank Accounts, it will show Checks and Payments and Deposits and Credits. For Credit Accounts, it will show Charges and Cash Advances and Payments and Credits. |

| • | The Date Range field will let you clear transactions based on a range of date. |

| • | The Reference Number field will let you clear transactions based on a transaction’s Reference Number. |

| • | The Ok button will execute filtering transactions based on your configurations. |

| • | The Cancel or X button will close the Clear Transactions form |

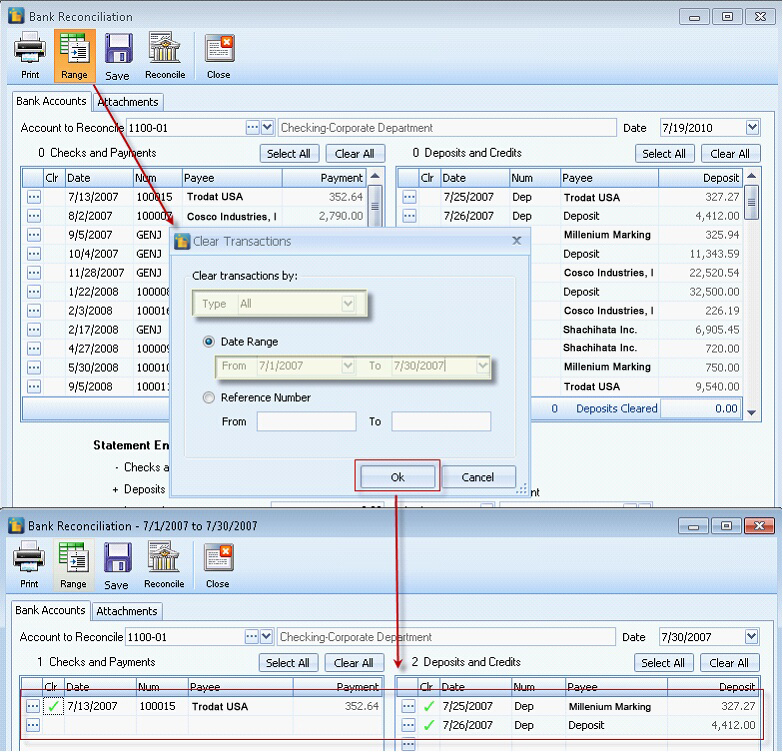

Example:

| 1. | If you chose All on the Type field and July 1, 2007 to July 30, 2007 on the date, all transactions based on the Type and date will be filtered out and marked as checked. |

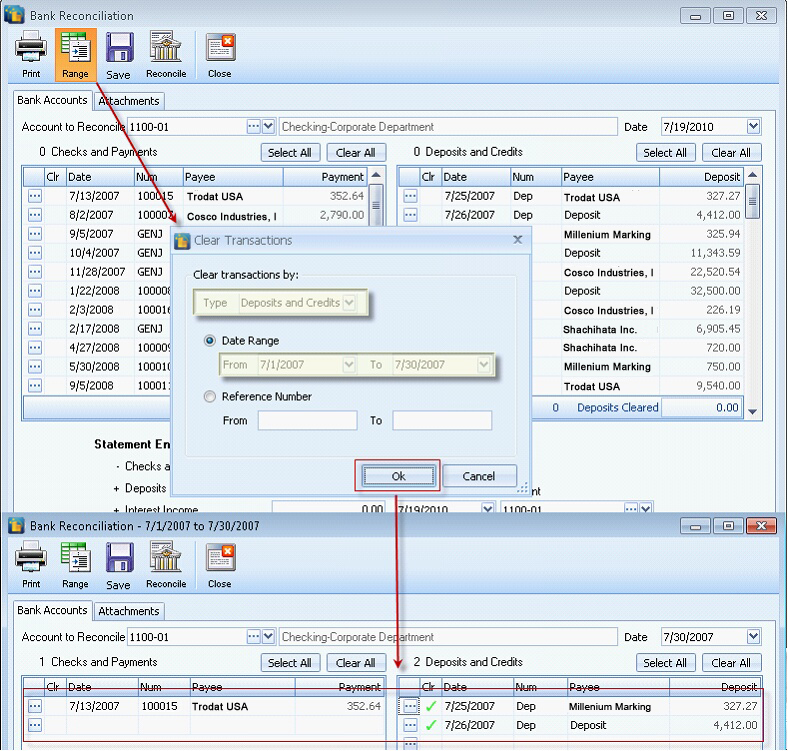

| 2. | However, if you set the Type field to other transaction types like Checks and Payments or Deposits and Credits on the same date range, the transactions will still be filtered out based on date range but only the chosen account grid will be checked. |

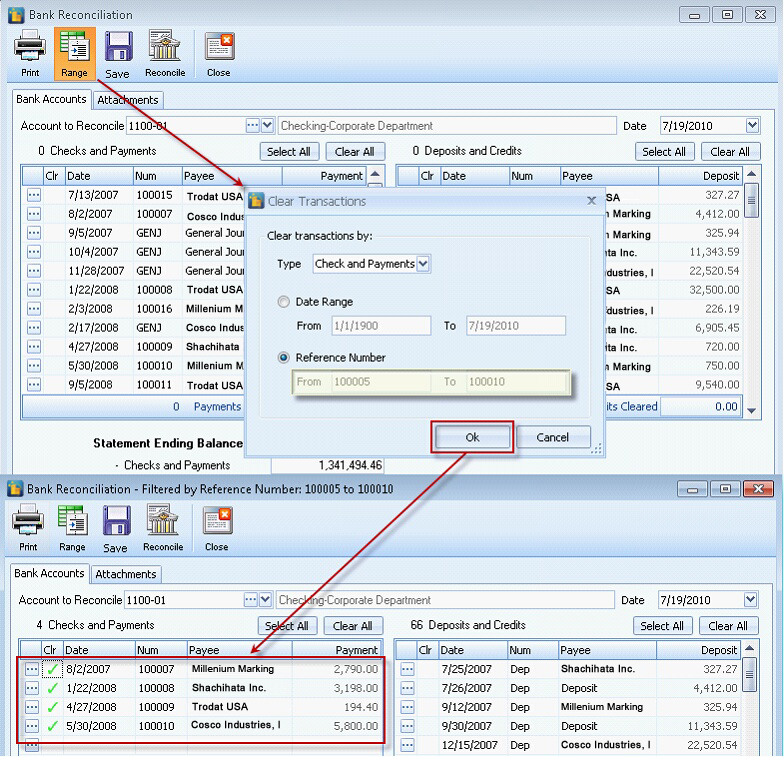

| 3. | If you chose to filter the transactions based on Reference Number instead of date range, the Type field will automatically be set to Checks and Payments or Charges and Cash Advances. |

The Save button will allow you to save the bank reconciliation data before doing the actual transaction.

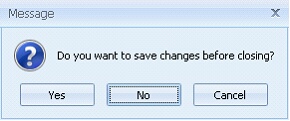

If you forgot to Save before closing the form, a message box will prompt confirming if you want to save the changes or not. If Yes is selected, the data will be saved but if No is selected, then nothing will be changed. For example if you saved $25.00 Interest Income and $10.00 Service Charge on April 28, 2009, these data will be available when you re-open the Bank Reconciliation form on the same date.

During Reconciliation, saving a transaction will mark the selected transactions as checked. When you close then reload the form, Custom Vantage Office will be able to remember the fields that were checked regardless of the date in the Reconciliation form.

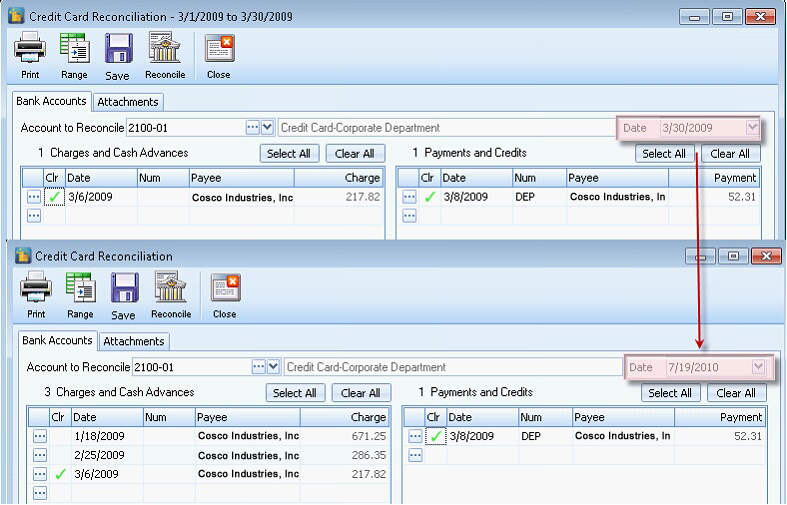

Example:

Filter a transaction from Mar. 1, 2009 to Mar. 30, 2009 then save the transaction. When you reopen the form on a different date, the form will still show the checked items.

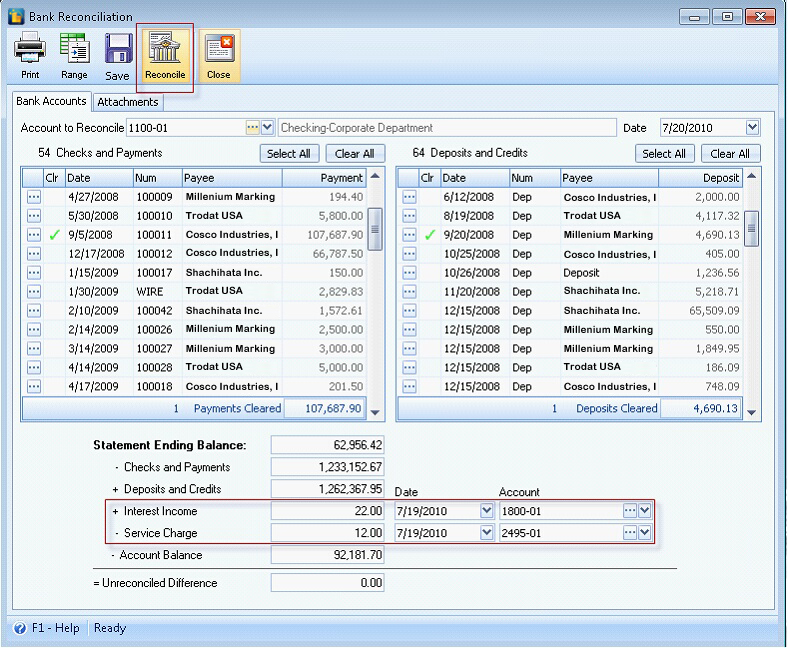

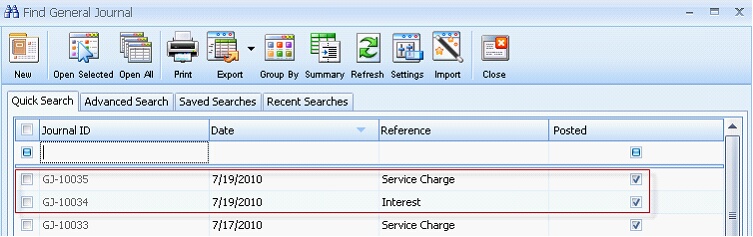

If there are amounts in the interest or service charge fields during bank reconciliation posting or simply clicking the Reconcile button, it will create a General Journal transaction and link the created transaction to the respective fields. This means that two separate General Journal transactions will be made for Interest Income and Service Charge.

Example:

Set $22.00 for Interest Income and $12.00 for Service Charge then post the transaction by clicking the Reconcile button.

Now, if you check the General Journal, you will see that there will be new entries for Interest Income and Service Charge. Notice that the date of the new entries is same with above sample.

Fields at the bottom of the form:

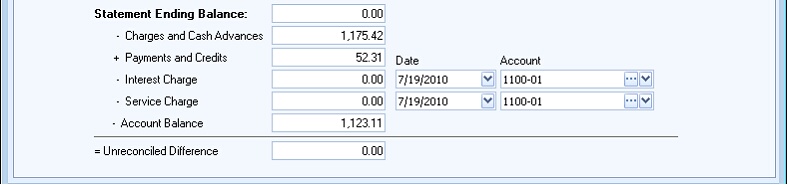

Credit Card Account:

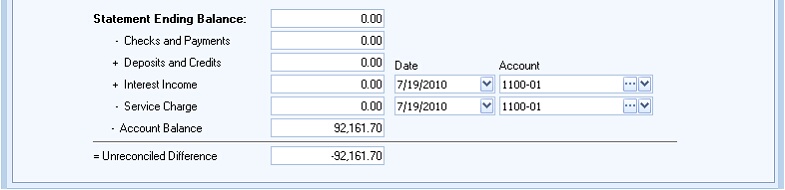

Bank Account:

| • | The Statement Ending Balance is a user input field. You have to type-in the statement ending balance indicated on your bank statement. |

| • | The Checks and Payments (Bank Accounts) or Charges and Cash Advances (Credit Card Accounts) field is the total of the unchecked transactions or line items in the Checks and Payments or Charges and Cash Advances grid. Checking a transaction on this section reduces the total amount. Each time you check or uncheck a transaction, the total on this field changes. |

| • | The Deposits and Credits (Bank Accounts) or Payments and Credits (Credit Card Accounts) field is the total of the unchecked transactions or line items in the Deposits and Credits or Payments and Credits grid. Checking a transaction on this section reduces the total amount. Each time you check or uncheck a transaction, the total on this field changes. |

| • | The Interest Income or Interest Charge field is a user input field. You have to type in the interest earned by the bank account or the interest charge when it is a credit card account. You have to specify the date and account id to record the revenue or expense. It is important that you select the proper account id because once the Reconcile button is clicked; the system will initiate the reconciliation process and create a posted General Journal transaction to record the income. The General Journal transaction is posted on the date selected for the Interest Income or Interest Charge. The created General Journal transaction is also automatically marked as cleared as it was part of the bank reconciliation process. |

| • | The Service Charge field is also a user input field. This holds the service charge automatically deducted from the company’s bank account as indicated in the bank statement. Same as how the Interest income is processed, a posted General Journal for the service charge is created each time the bank account is reconciled. The created General Journal transaction is also automatically marked as cleared as it was part of the bank reconciliation process. |

| • | The Account Balance field is a read-only field. It shows the account balance of the selected account as of the date indicated on the upper right portion of the Bank Reconciliation form > Date field. |

| • | The Unreconciled Difference is a read-only and computed field. |

Changes on the Bank Reconciliation report

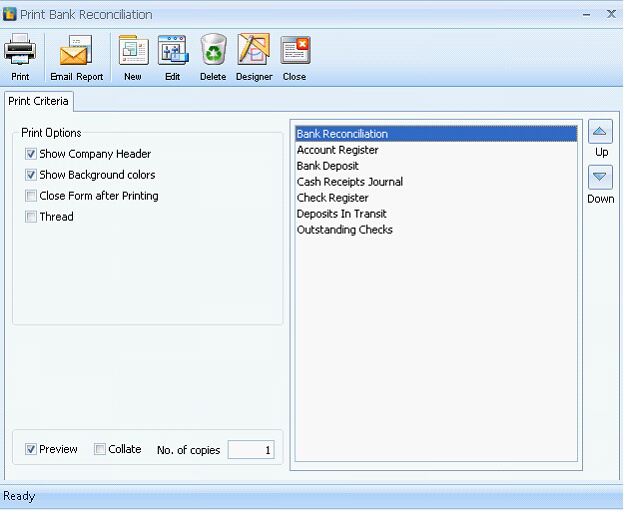

If you click the Print button it will show the Print form where you can select the Report Name you want to print.

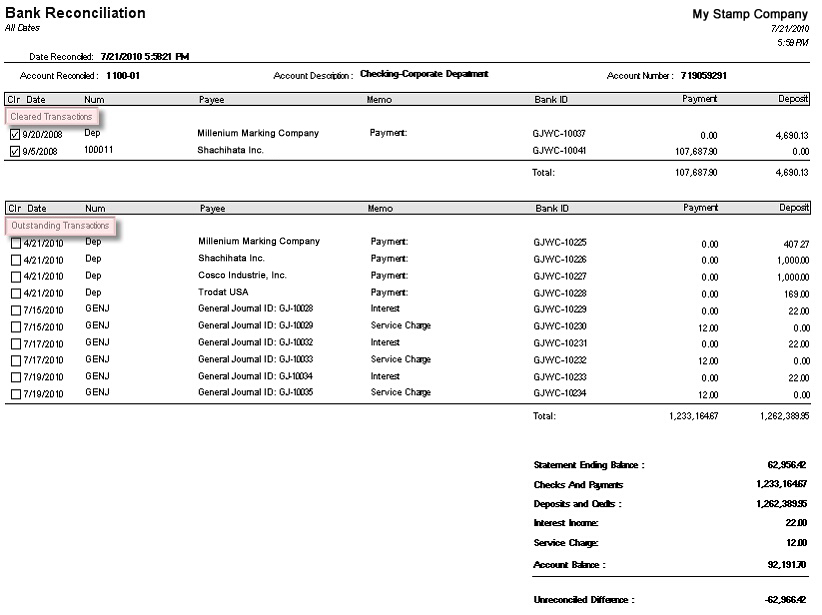

| • | The Bank Reconciliation report shows the summary of the reconciled account. The printed report is divided into two groups: Cleared Transactions and Outstanding Transactions. The summary fields found at the bottom of the Bank Reconciliation form will also be found at the bottom of the report. |

| • | The Account Register report shows a summary of all the bank accounts and credit accounts status. |

| • | The Bank Deposit report displays all deposit transaction. |

| • | The Cash Receipts Journal report shows all posted invoices and the receive payment activities that happened within a bank account. |

| • | The Check Register report shows all transactions that transpired on a check account. In Custom Vantage Office, all the related transaction for a bank or credit card account is displayed. |

| • | The Deposit in Transit report shows all the deposit transactions that are not yet cleared. |

| • | The Outstanding Checks report shows all check transactions that are not yet cleared. |