Enhancements on 1099 Reports

The following are the changes made to the 1099 Reports of Custom Vantage Office.

| I. | If a vendor has a 1099-eligible bill in one year that is paid in another year, then the eligible bill will not appear when printing Form 1099 report on the year when the bill was created, instead on the year where the bill was paid. |

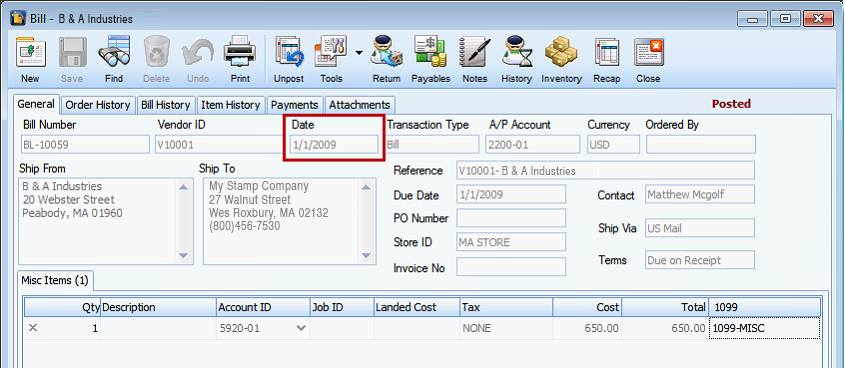

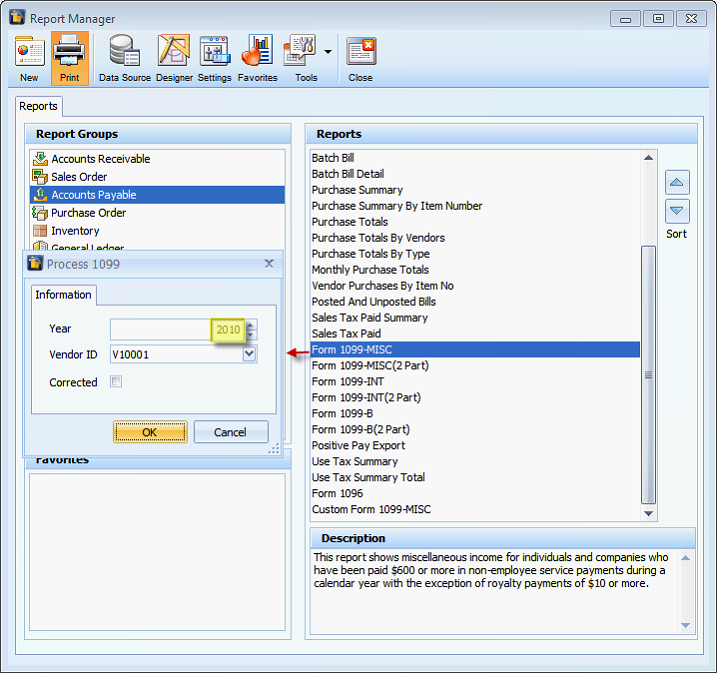

Example:

Bill was created and posted on 01/01/2009.

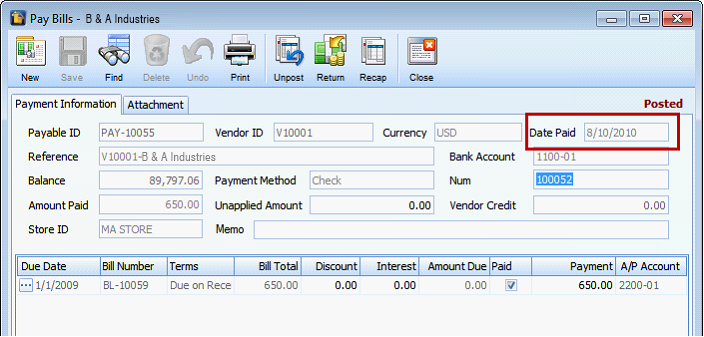

But the associated payable is paid a year after.

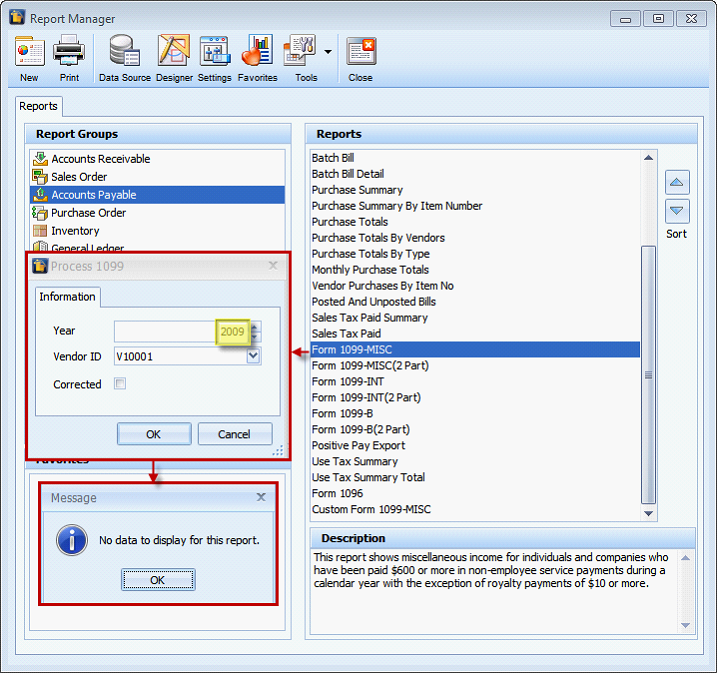

When you print Form 1099-MISC report for 2009, there will be no data to display.

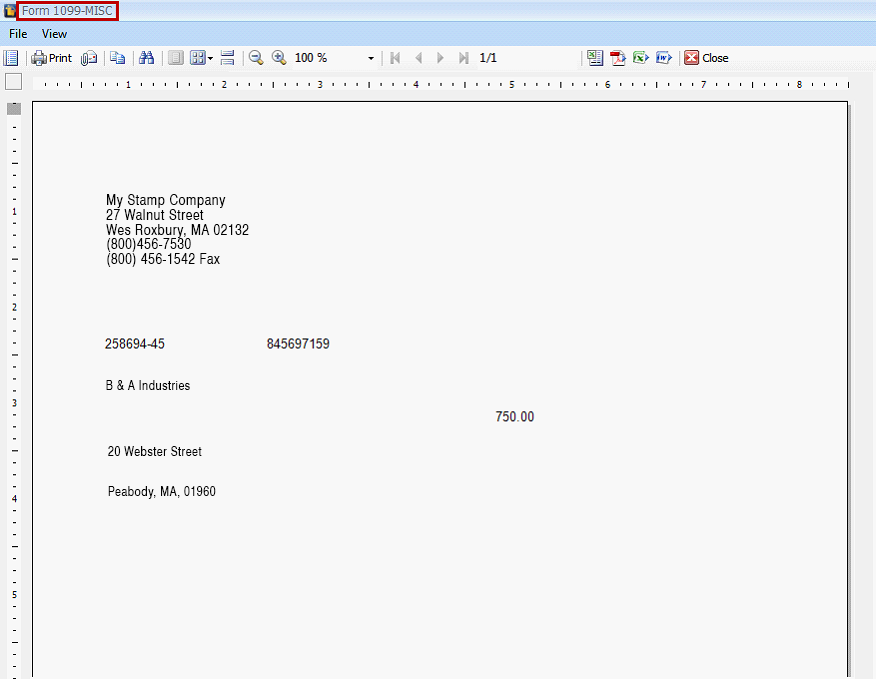

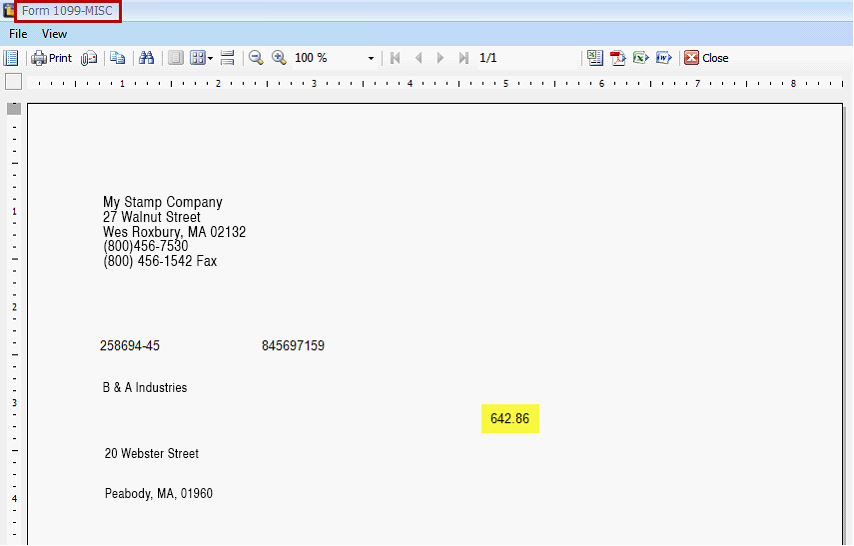

However when you print Form 1099-MISC report for year 2010, a report will be printed showing the amount of the eligible bill.

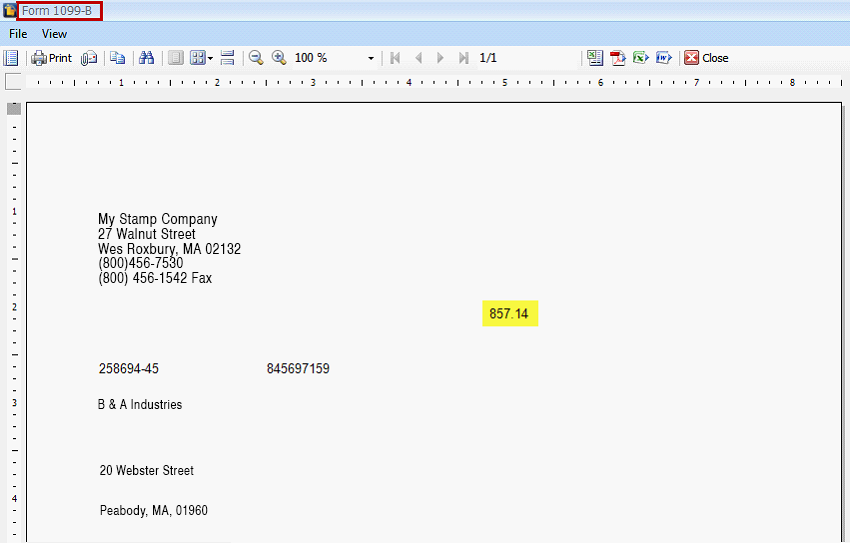

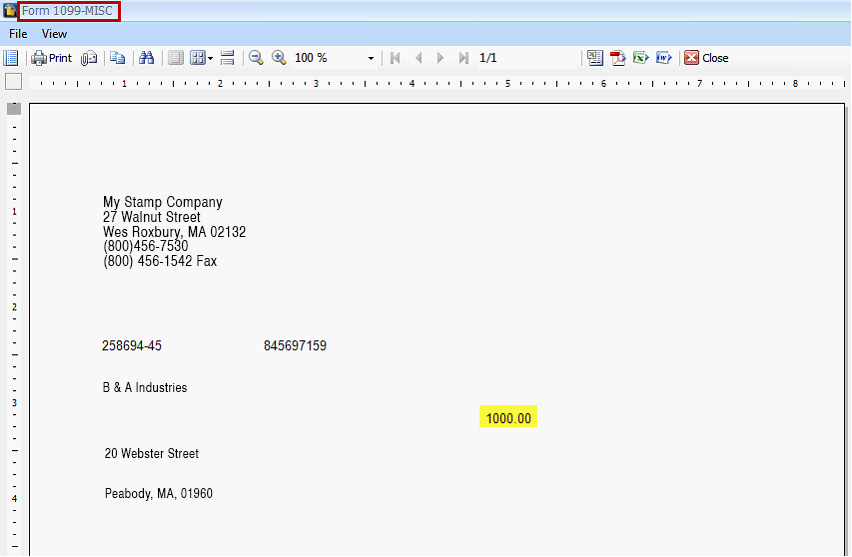

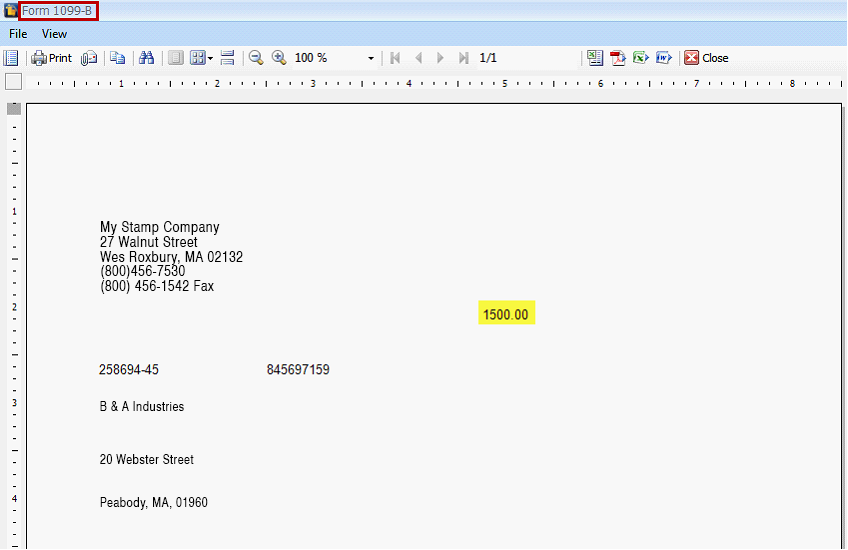

Generated report

II. 1099 Reports has now the ability to restore the amount on the bill detail subtotal as oppose to the bill order total field. This means that a Bill can contain items having 1099 and non-1099 type but will only show a subtotal on the 1099 report according to its type.

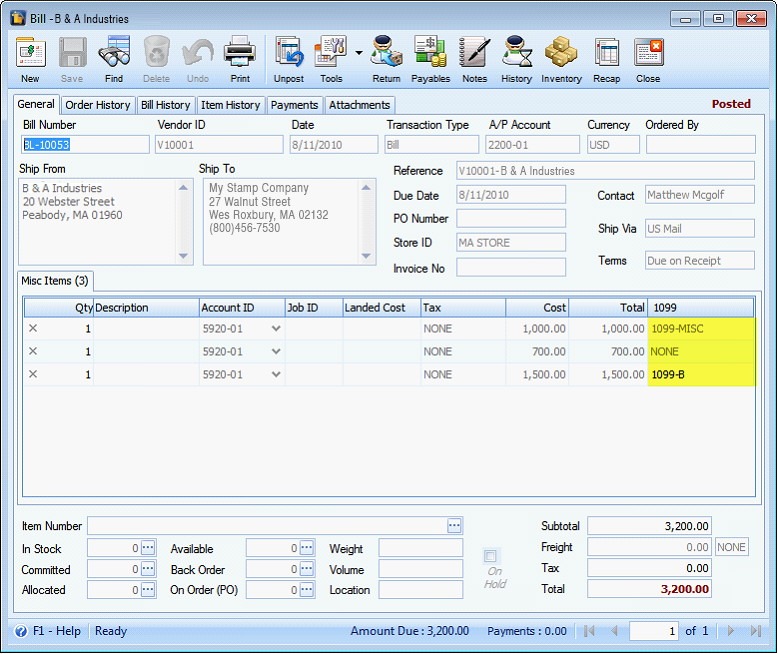

Example:

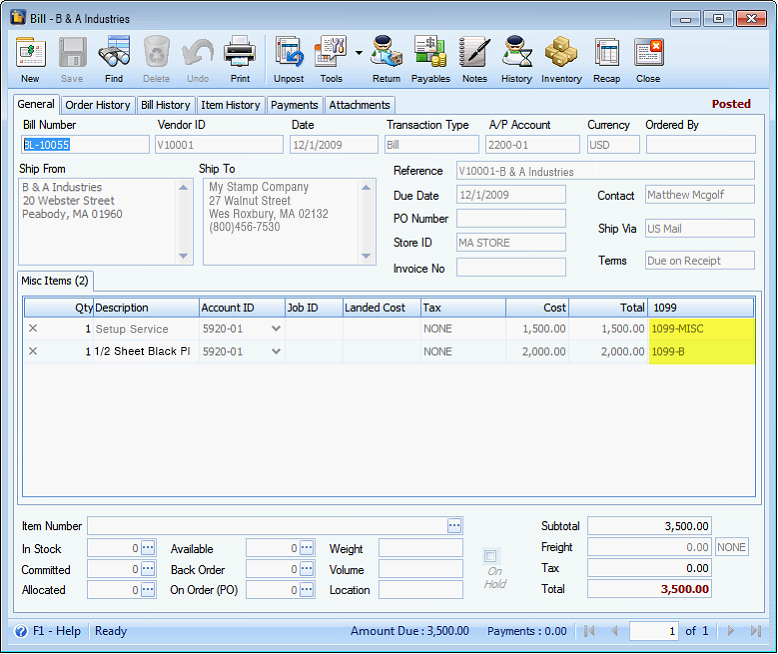

BL-10053 has 3 items with 1099 MISC, 1099-B, and a non-1099 type.

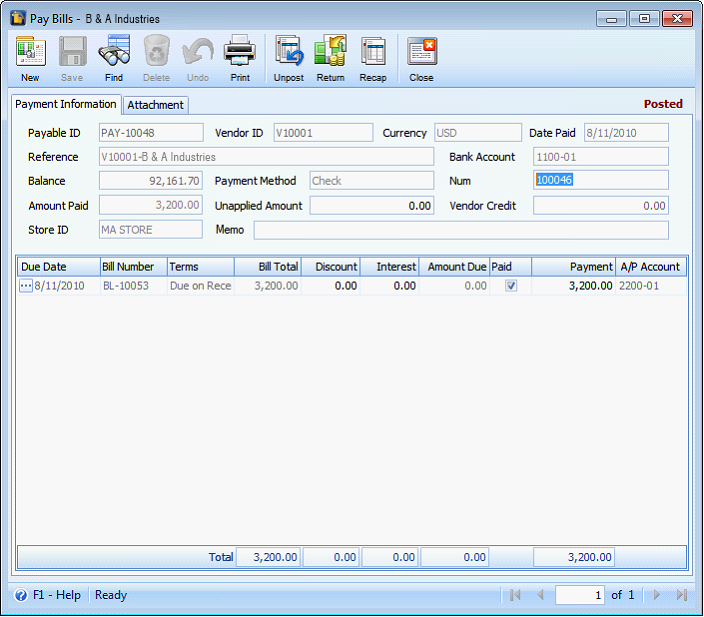

This is the created Pay Bill for BL-10053.

When you print 1099-MISC report, it will only display $1000 because only 1 item has the 1099 type.

Same thing will happen when you print 1099-B report.

| II. | If a Bill with multiple detail is set up with different 1099 types and is partially paid in two or more different calendar years, then all the 1099 bill detail amounting to up to the last 30 decimal values will be added before rounding it off to two decimal places and the rounded amount will be shown in the report. |

Example:

BL-10055 was created on 12/1/2009 having different types of 1099 with the Total Bill of $3500.

| • | Setup Service - $1500 and is assigned to 1099-MISC |

| • | Sheet Service - $2000 and is assigned to 1099-B |

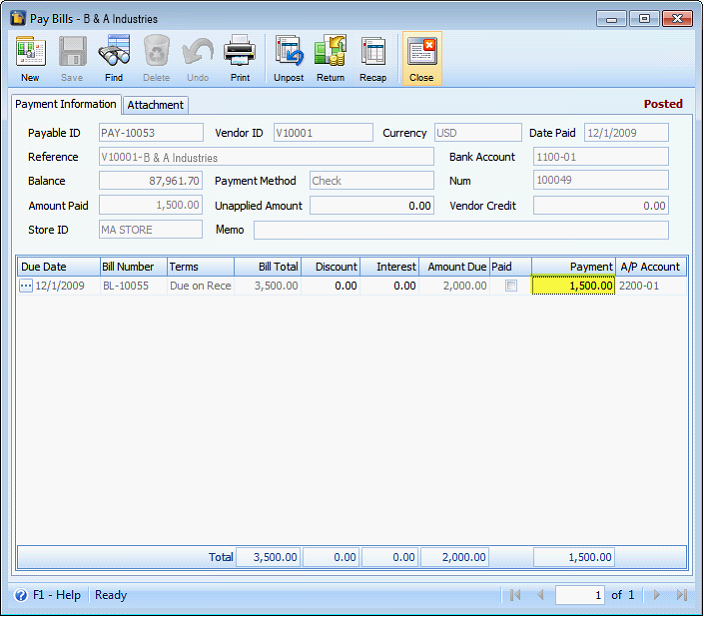

This bill was partially paid by $1500 on 12/1/2009. This amount should be proportioned to the bill details with no significant loss in the decimal values.

Using this formula: Bill Detail / Bill Total * Payment, here’s how the bill detail will contribute to 1099 reports for year 2009:

| • | Setup Service will contribute $642.857142857142900000000000000000 (with 30 decimal places) to 1099-MISC report. (1500/ 3500 * 1500=642.86) |

| • | Sheet Service will contribute $857.142857142857100000000000000000 (with 30 decimal places) to 1099-B report. (2000/ 3500 * 1500=857.14) |