FORM 1099

IRS Form 1099 is used by American taxpayers to file their Federal income taxes with the United States Internal Revenue Service. This is used to report information on various types of income other than wages, salaries, and tips.

United States Federal tax law requires businesses to submit a Form 1099 for every independent contractor they pay for services valued at more than $600.00 a year.

Variations of Form 1099 in Custom Vantage Office

1099-MISC - It is used to report miscellaneous income for individuals and companies who have been paid $600 or more in non-employee service payments during a calendar year with the exception of royalty payments of $10 or more.

See Form 1099-MISC Limit topic for a detailed example on how 1099-MISC form works.

1099-INT - The statement you receive from payers of interest income, such as banks and savings institutions, that summarizes your interest income for the year. This form is also used to report other tax items related to your interest income, such as early withdrawal penalties, federal tax withheld, and foreign tax paid.

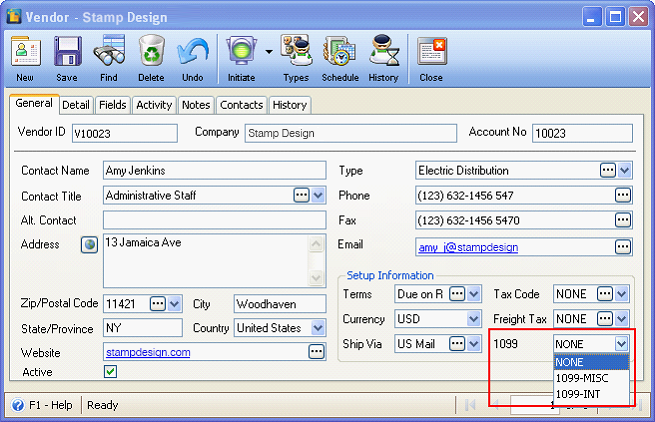

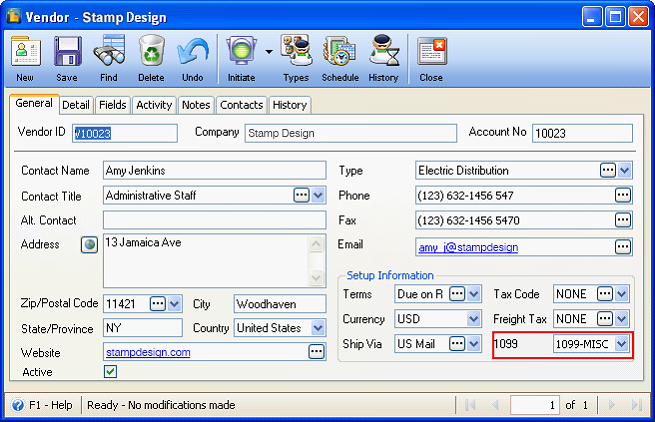

How to set up 1099 on Vendors form

In the Vendor form > General tab there is 1099 field combo box. There are 3 options to select from: None, 1099-MISC and 1099-INT. NONE is shown by default.

For example, 1099-MISC is selected for Vendor: Gramma’s Design.

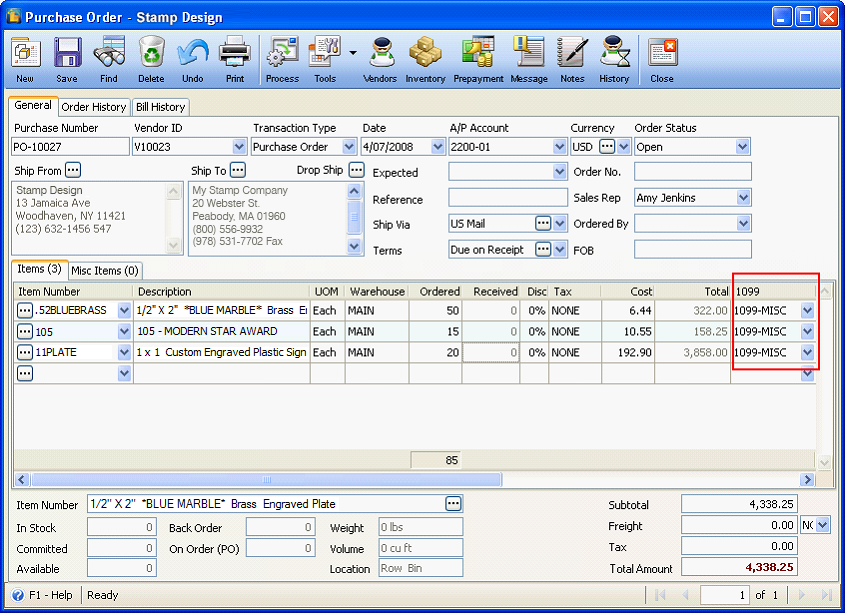

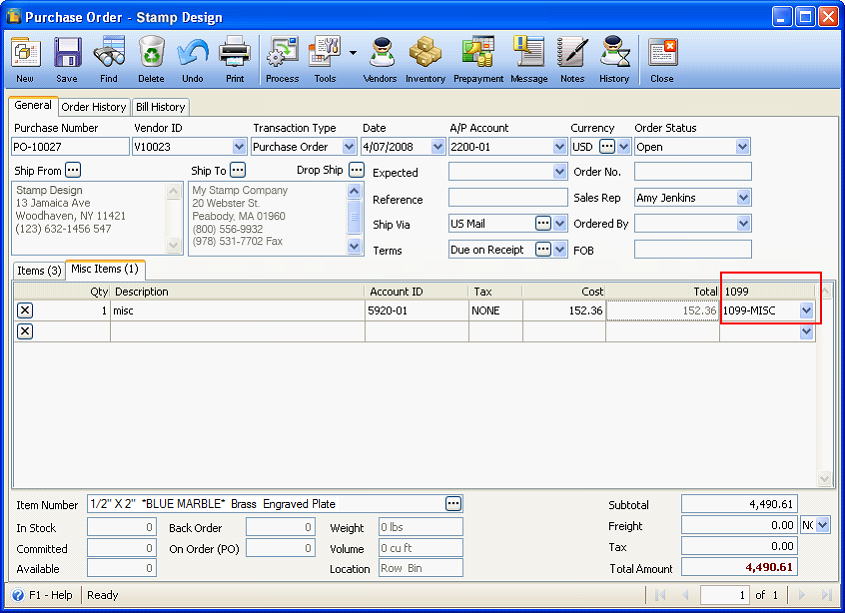

Then when you create a Purchase Order, Purchase Receipt or Bill for that vendor, every line item selected for Items and Misc Items tab, the said 1099 set in Vendor form will be the default 1099.

Processing 1099 Reports

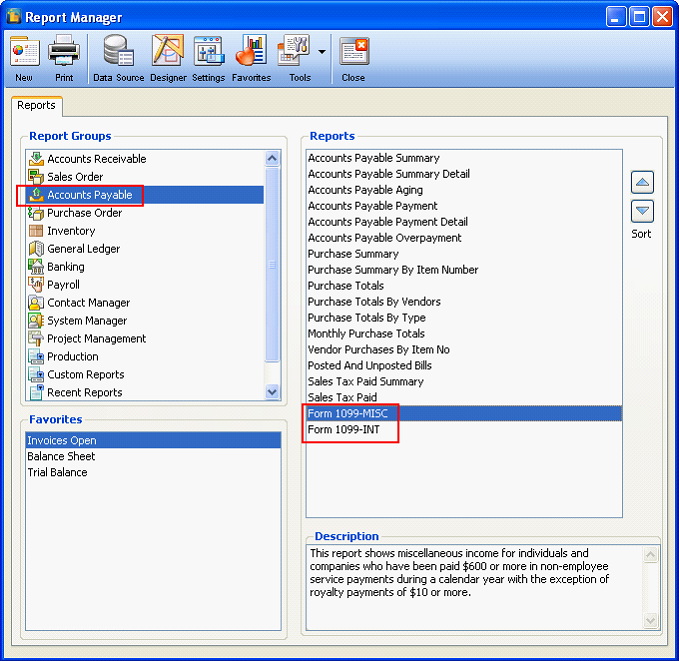

From the Report Manager, highlight Accounts Payable from the Report Groups, then choose between Form 1099-MISC or Form 1099-INT.

Since in our example above we use 1099-MISC, then we will select Form 1099-MISC.

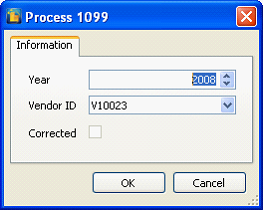

To process 1099, specify the Year and Vendor ID to be processed. On the first time of processing 1099 for a certain year and vendor ID, corrected checkbox will be disabled. Click OK and the Form 1099-MISC report will open.

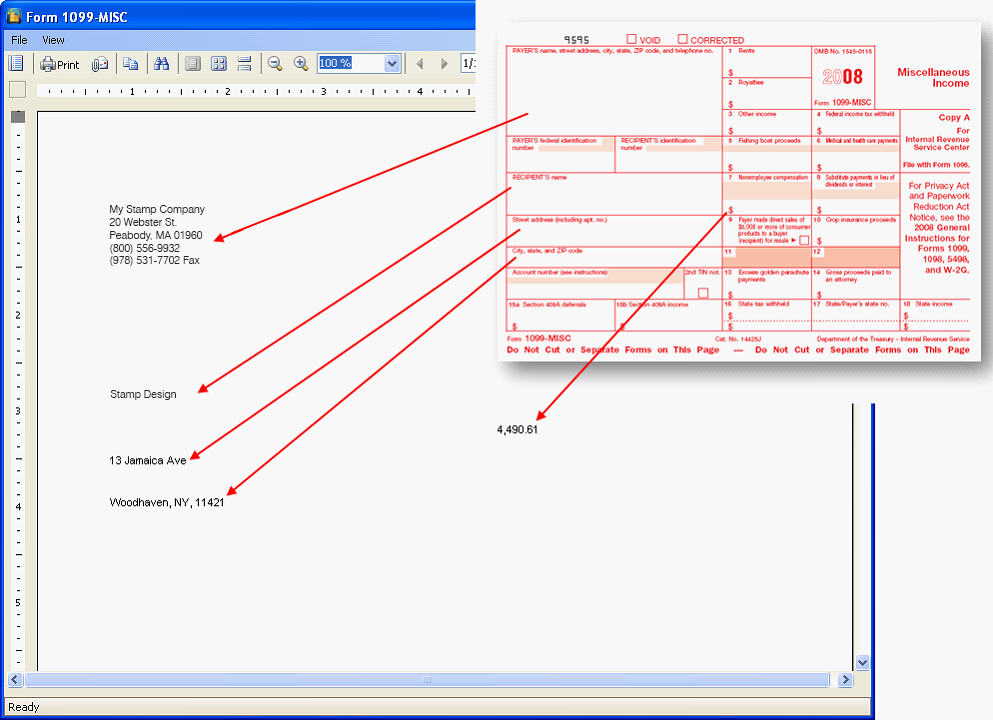

This is how Form 1099-MISC will look like.