Landed Cost

What is a Landed Cost

Landed cost includes all charges associated with getting an inventory item into your warehouse and available for use or sale. These charges may include material, freight, insurance, duty, and handling.

Landed Cost Process

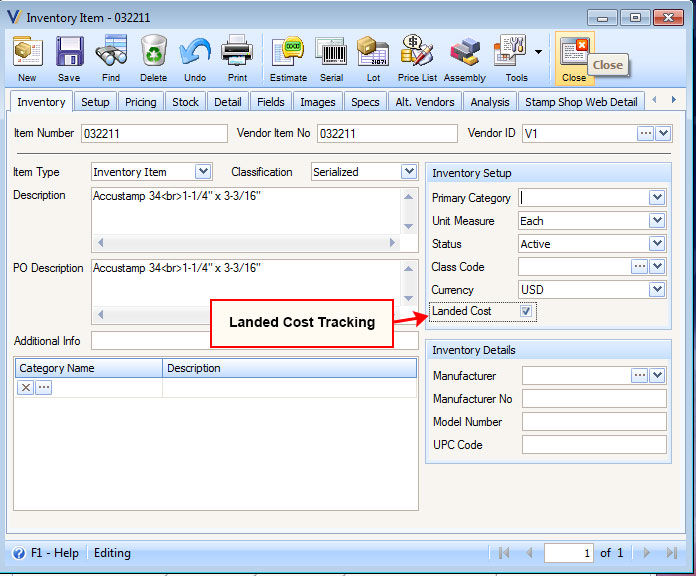

| 1. | Create a new inventory item and enable the Track Landed Cost check box. |

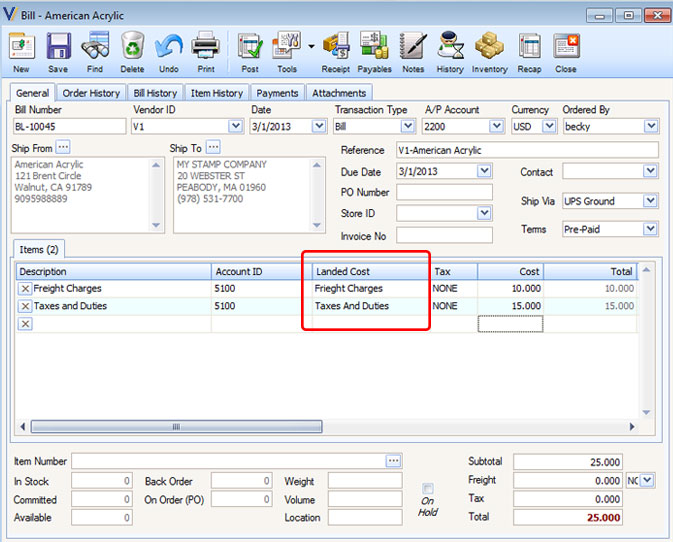

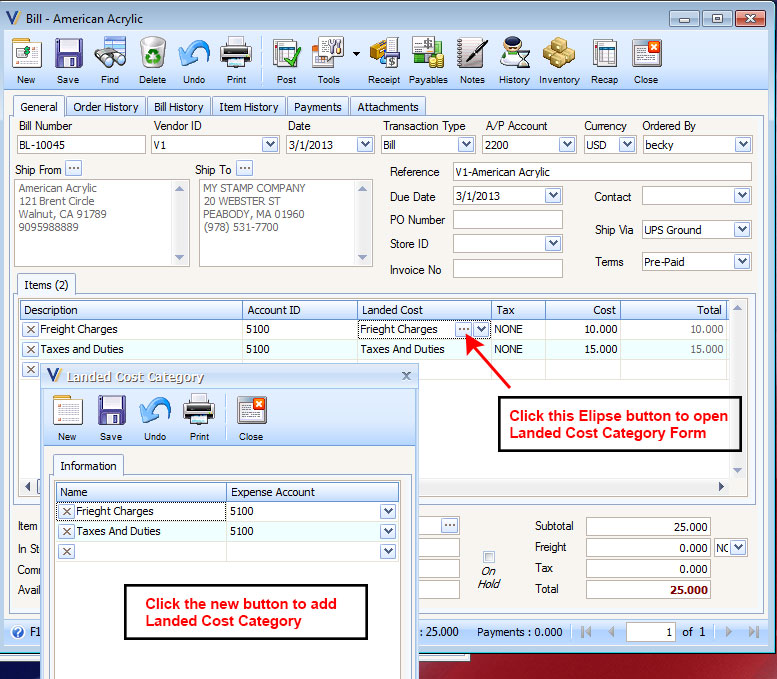

| 2. | Create a new Bill for Vendor to be used in Purchase Receipt for the allocation of landed cost charges. Add misc items and set the LC category for each item. |

Once you are on the LC Category field, an ellipse button will be shown that when clicked will open the Landed Cost Category form. On that form, you can modify the Expense account that will be used as the default expense account of the selected LC Category. You can also add unlimited Landed Cost Category and assign expense account for each Landed Cost Category.

Also, when an LC Category is selected, the Account ID next to the Description field will automatically be replaced with the Expense Account assigned to the selected LC Category.

Then post this bill.

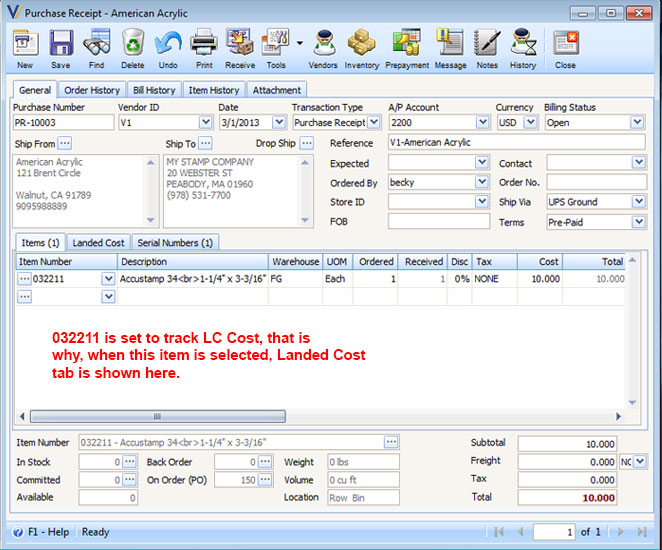

| 3. | Create a new Purchase Receipt for that same vendor. Select LCSAMPLEITEM in the item field of inventory items grid. |

![]() Note that when item with the Track Landed Cost box marked on their record is selected and a Landed Cost category is assigned, the Landed Cost tab will be shown next to Misc Items tab.

Note that when item with the Track Landed Cost box marked on their record is selected and a Landed Cost category is assigned, the Landed Cost tab will be shown next to Misc Items tab.

There is no limit up to how many line items you may add on this Purchase Receipt. Each item will be separately charged depending on the bill that will be allocated to it.

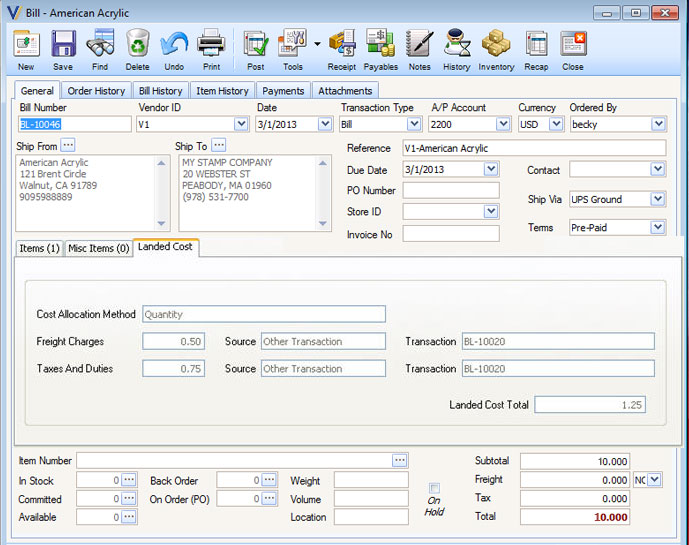

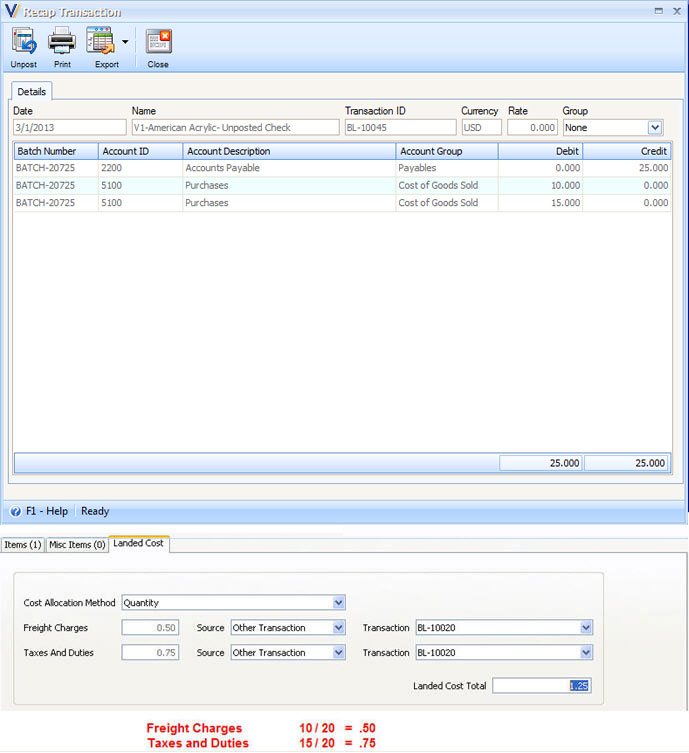

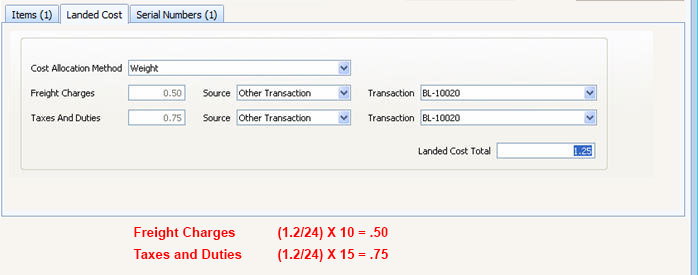

| 4. | In the Landed Cost Tab, select the allocation method to be used. In the Source field, select Other Transactions, then a dropdown arrow button will be shown on the Transaction field to allow you to select a Bill associated to the Purchase Receipt. |

Upon selection of a bill, which in this example is BL-100020, the Freight Charges, Taxes and Duties and Landed Cost Total field will be filled in automatically.

Below are the allocation methods to select from and how they are computed.

a. Weight

Allocated Cost per item = (weight of each item / total weight of eligible items) * total landed cost

On our example above, if Weight is selected, landed cost area will show these values.

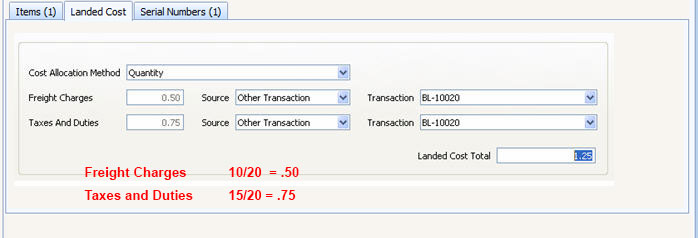

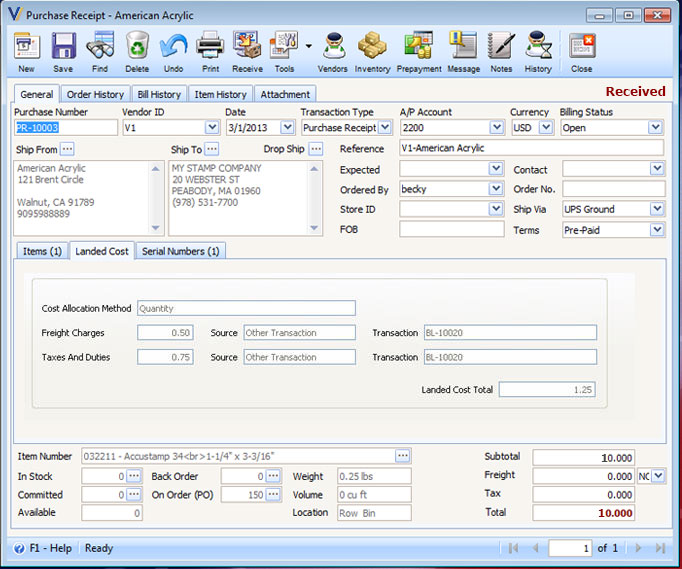

| b. Quantity |

Allocated Cost per item = total landed cost / number if eligible items

On our example above, if Quantity is selected, landed cost area will show these values.

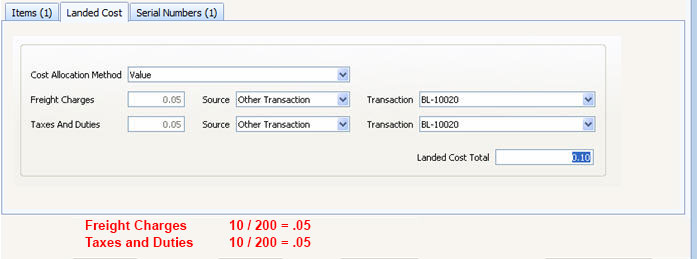

c. Value

Allocated Cost per item = value of each item / total value of eligible items

On our example above, if Value is selected, landed cost area will show these values.

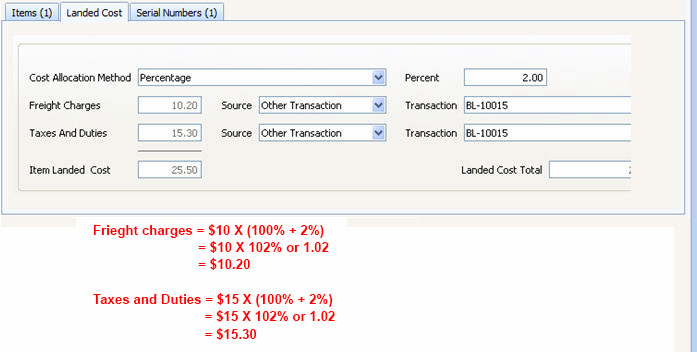

| d. Percentage |

Allocated Cost per item = total landed cost x (100% + percent entered)

On our example above, if Percentage is selected, landed cost area will show these values.

| 5. | Receive the items and process Purchase Receipt to Bill. |

After processing, this is how the new Bill will look like.