Retrieve 941 SS Limits from WH32

When generating tax reports (like 941 report), the payroll-related taxes that a company/employee remits to the government are constraint within a yearly limit. If the total wages of an employee is below the limit, it will not be subjected to tax. On the contrary, over the limit means the company or employee has to pay a tax.

Every year the limit changes and most of the time it increases. The change is usually governed by the US government. This means, each year Custom Vantage Office needs to make sure the limits are increased. If the limits are outdated, it causes wrong calculation of the tax reports.

Custom Vantage Office uses WH32, a third party control, which stores the current tax limits. This will insure that the data is correct as long as the WH32 component is updated on the server. This is one reason why it is important to run Custom Vantage Office updates on the server even though the server is not used for day to day operations.

On Custom Vantage Office’s part, Form 941 report will retrieve the limits from the WH32 component.

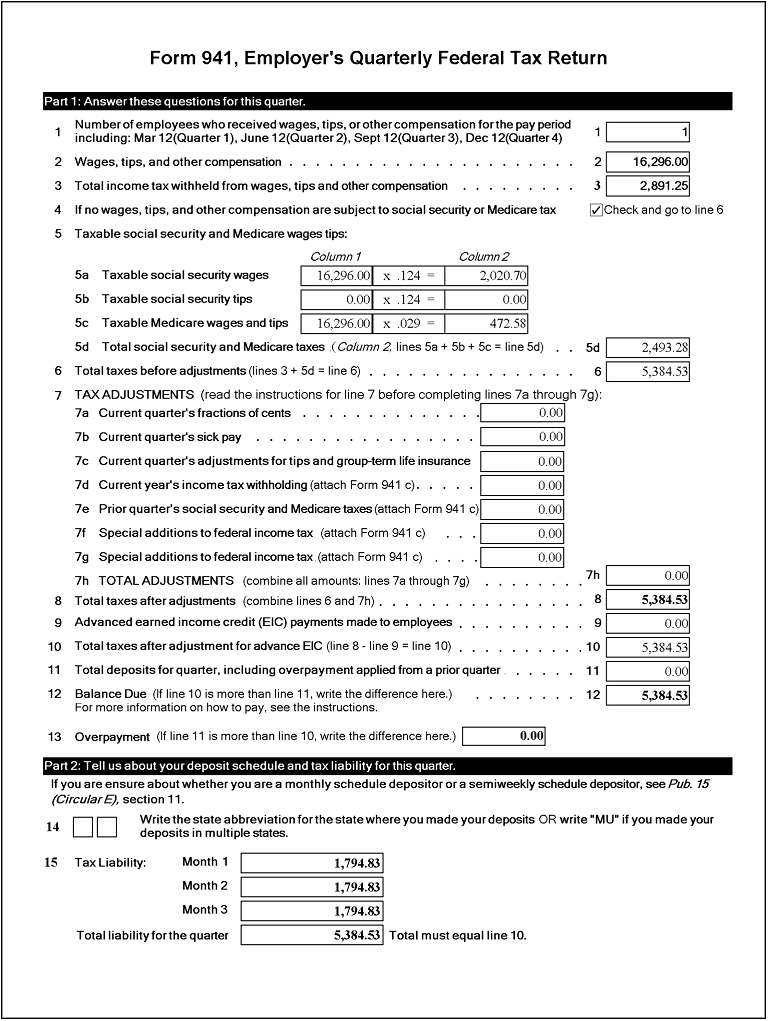

This is a Form 941 report .